Is the US Stock Market Doing Well? A Comprehensive Analysis

In recent years, the US stock market has been a hot topic of discussion among investors and financial experts. With the rise of digital platforms and the increasing accessibility of financial information, many individuals are now looking to invest in the stock market. But is the US stock market currently doing well? Let's delve into this question and explore the various factors that contribute to its performance.

Historical Performance

To understand the current state of the US stock market, it's essential to look at its historical performance. Over the past few decades, the US stock market has delivered impressive returns, with the S&P 500 index, a widely followed benchmark, posting an average annual return of around 10% since its inception in 1923. This historical performance has made the US stock market a popular destination for investors seeking long-term growth.

Current Market Trends

As of early 2023, the US stock market is experiencing several key trends that indicate its overall health:

- Record-high Stock Prices: The S&P 500 index has reached new all-time highs, reflecting strong investor confidence and a robust economy.

- Earnings Growth: Many companies in the S&P 500 are reporting strong earnings growth, driven by factors such as increased consumer spending and improved business operations.

- Low Interest Rates: The Federal Reserve has kept interest rates low to support economic growth, which has made stocks more attractive compared to other investment options like bonds.

Sector Performance

While the overall US stock market is performing well, it's important to note that different sectors are experiencing varying levels of growth:

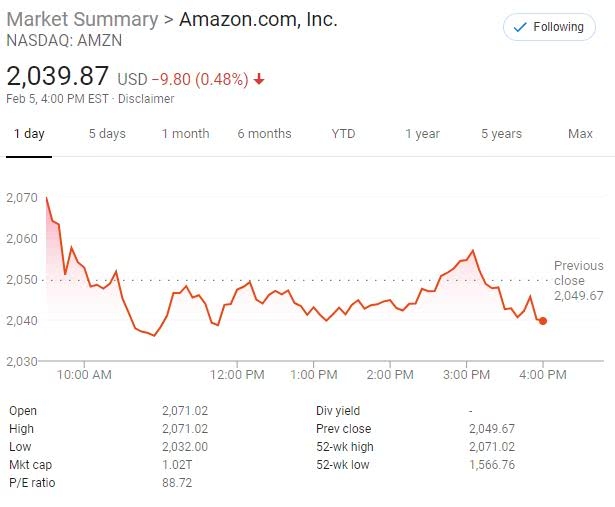

- Technology: The technology sector has been a major driver of stock market performance, with companies like Apple, Microsoft, and Amazon delivering strong earnings and stock price gains.

- Healthcare: The healthcare sector has also seen significant growth, driven by factors such as an aging population and advancements in medical technology.

- Energy: The energy sector has experienced a resurgence, thanks to the rise of renewable energy sources and increased oil and gas production.

Risks and Challenges

Despite the positive trends, the US stock market is not without its risks and challenges:

- Inflation: Rising inflation has raised concerns about the potential for higher interest rates, which could negatively impact stock prices.

- Geopolitical Tensions: Tensions between major economies, such as the US and China, could lead to trade disputes and disrupt global supply chains.

- Economic Slowdown: A potential economic slowdown could lead to lower corporate earnings and a decline in stock prices.

Conclusion

In conclusion, the US stock market is currently performing well, driven by factors such as strong corporate earnings, low interest rates, and a robust economy. However, investors should be aware of the risks and challenges that could impact the market's performance. By staying informed and making informed investment decisions, investors can navigate the US stock market and potentially achieve their financial goals.

us stock market today

like

- 2026-01-19How to Trade US Stocks in Hong Kong: A Comprehensive Guide"

- 2026-01-19Trading US Stocks for Non-Residents: A Comprehensive Guide

- 2026-01-19Understanding the US Stock Exchange Market Hours: A Comprehensive Guide

- 2026-01-19Is the US Stock Market Open on Dec 24, 2021?

- 2026-01-19Can You Get Nintendo Stock US? A Comprehensive Guide

- 2026-01-19Ishares US Infrastructure ETF Stock: A Comprehensive Guide"

- 2026-01-19Stock Market US Holidays 2023: Key Dates to Remember

- 2026-01-22Understanding Margin Requirements for US Stocks: What You Need to Know

- 2026-01-22Momentum Stocks: Top Performers Past 5 Days in the US Market

- 2026-01-19Unlocking the Potential of Boeing US Defense Stocks: A Comprehensive Guide"