China-US Trade News: Stock Market Implications

The relationship between China and the United States has always been a major factor in global economic and stock market trends. Recent developments in China-US trade news have sent ripples through the stock market, prompting investors to re-evaluate their portfolios. This article delves into the latest trade news between the two countries and its implications for the stock market.

Recent Developments in China-US Trade

Over the past few years, China and the United States have engaged in a trade war that has impacted the global economy. In recent months, both countries have made moves to de-escalate tensions, including the signing of phase one of a trade deal.

Implications for the Stock Market

The China-US trade news has had a significant impact on the stock market. Here's a closer look at how:

Technology Sector: The technology sector has been particularly sensitive to trade tensions. Companies like Apple, which rely heavily on Chinese manufacturing, have seen their stocks fluctuate due to trade news.

Auto Industry: The auto industry is another sector that has been impacted by China-US trade. Many car manufacturers have significant operations in China, and tensions have caused uncertainty regarding future investment and supply chains.

Retail Industry: The retail industry has also felt the heat. Brands like Nike and Gap have reported lower sales in China, partly due to trade tensions and anti-American sentiments.

Agriculture: The agriculture sector has been one of the hardest-hit areas in the trade war. American farmers have faced reduced demand for their products in China, leading to falling prices and job losses.

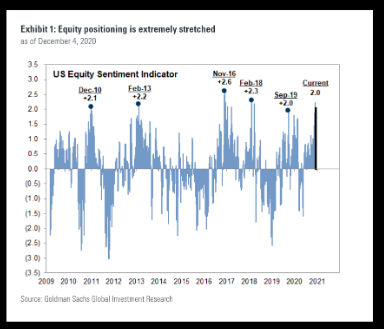

Overall Stock Market Trends: The stock market has reflected the volatility in China-US trade news. Investors have become increasingly cautious, leading to higher volatility and more frequent trading corrections.

Case Studies

Apple: Apple's stock has been volatile over the past few years, largely due to trade tensions. After the signing of the phase-one trade deal, Apple's stock saw a significant rise, indicating a positive impact on the company's operations in China.

General Motors (GM): GM has a significant presence in China, with operations including manufacturing, sales, and service. Trade tensions have caused uncertainty regarding the company's future in the Chinese market.

Nike: Nike's sales in China have been impacted by the trade tensions and anti-American sentiments. The company has had to adjust its strategies to maintain its market share in China.

Conclusion

The China-US trade news continues to dominate global headlines, and its implications for the stock market are significant. As tensions ease and trade relations improve, investors can expect the stock market to stabilize. However, caution remains paramount, as trade issues can quickly escalate and impact the global economy.

us stock market today

like

- 2026-01-19How to Buy US Stocks with TD Direct Investing: A Step-by-Step Guide

- 2026-01-19iShares Total US Stock Market: Your Ultimate Guide to Investing

- 2026-01-19Fred Us Hoising Stock: Exploring the Rise and Future of a Promising Investment

- 2026-01-19Top US Energy Stocks: A Comprehensive Guide to Investment Opportunities

- 2026-01-22Low PE Stocks: A Smart Investment Strategy in the US

- 2026-01-19Gillette Stock Price US: Current Trends and Future Projections

- 2026-01-19Ishares US Infrastructure ETF Stock: A Comprehensive Guide"

- 2026-01-19How Malaysians Invest in U.S. Stocks: A Comprehensive Guide"

- 2026-01-19NASA Stock Price: A Comprehensive Guide to Investing in America's Space Agency

- 2026-01-19e Dow Jones US Completion Total Stock Market Index: A Comprehensive Guide