Understanding the Ins and Outs of LB US Stock: A Comprehensive Guide

In today's fast-paced financial world, understanding the intricacies of LB US stock is crucial for both seasoned investors and newcomers alike. Whether you're looking to diversify your portfolio or simply keep up with the latest market trends, this article will provide you with a comprehensive guide to LB US stock. From its definition and history to key features and potential risks, we'll cover it all.

What is LB US Stock?

LB US stock refers to the shares of a company that are traded on the United States stock exchange. These shares represent ownership in the company and can be bought and sold on the open market. The term "LB" typically stands for "Limited," indicating that the company is a limited liability corporation. This means that the shareholders' personal assets are protected from the company's debts and liabilities.

History of LB US Stock

The concept of stock trading dates back to the 17th century, when the Dutch East India Company became the first publicly traded company. Over the centuries, the stock market has evolved, and today, it is one of the most powerful and influential financial markets in the world. LB US stock has played a significant role in this evolution, providing investors with access to a wide range of companies across various industries.

Key Features of LB US Stock

- Dividends: Many LB US stocks pay dividends to their shareholders, which are a portion of the company's profits distributed to investors.

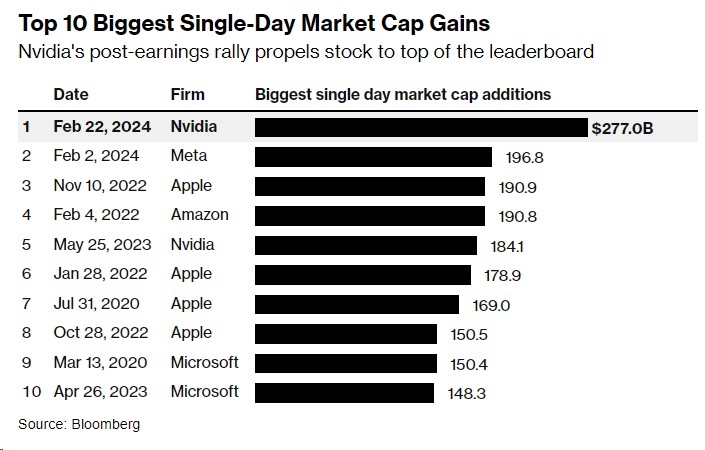

- Market Capitalization: The market capitalization of a company is the total value of its outstanding shares. This metric is used to determine the size and stability of a company.

- Trading Hours: LB US stocks are typically traded during regular business hours, from 9:30 AM to 4:00 PM Eastern Time.

- Investment Opportunities: Investing in LB US stock can provide investors with exposure to a wide range of industries, including technology, healthcare, finance, and more.

Potential Risks

While investing in LB US stock can be lucrative, it also comes with potential risks. Some of the key risks include:

- Market Volatility: The stock market can be unpredictable, and prices can fluctuate significantly in a short period.

- Economic Factors: Changes in the economy, such as interest rates and inflation, can impact the performance of LB US stocks.

- Company-Specific Risks: Issues within a company, such as poor financial performance or management problems, can negatively impact its stock price.

Case Studies

To illustrate the potential of LB US stock, let's look at a few case studies:

- Apple Inc.: Since its IPO in 1980, Apple has become one of the most valuable companies in the world. Its stock has provided investors with significant returns over the years, despite occasional market volatility.

- Amazon.com, Inc.: Launched in 1994, Amazon has grown to become one of the largest retailers in the world. Its stock has experienced rapid growth, offering investors substantial returns.

- Facebook, Inc.: Originally known as TheFacebook, Facebook has become a dominant player in the social media space. Its stock has seen significant growth, although it has faced challenges related to data privacy and regulatory concerns.

Conclusion

Understanding LB US stock is essential for anyone looking to invest in the U.S. stock market. By familiarizing yourself with the key features, potential risks, and historical trends, you can make informed investment decisions and potentially achieve significant returns. Remember to do thorough research and consult with a financial advisor before making any investment decisions.

us flag stock

like

- 2026-01-23US Large Cap Momentum Stocks to Watch in 2025

- 2026-01-23Marketplace Today: The Dynamic Ecosystem of Online Retail"

- 2026-01-23Understanding US Capital Gains Tax for Nonresident Aliens on Stocks

- 2026-01-22Top Dividend Yield Stocks in the US: A Comprehensive Guide

- 2026-01-22Baba Stock Price US: A Comprehensive Analysis of the Market Dynamics

- 2026-01-19Stock Market Response to US Election: Insights and Implications

- 2026-01-22Small Cap Defense Stocks: A Strategic Investment for the Future

- 2026-01-22Pre-Market Movers Today: US Stocks to Watch

- 2026-01-19Hudbay Minerals Stock US: A Comprehensive Analysis

- 2026-01-22Daimler Stock US: A Comprehensive Analysis of Mercedes-Benz’s Financial Performance