Understanding How US Stocks Work for International Students

Are you an international student interested in investing in the US stock market? Understanding how it works can be a game-changer for your financial future. This article will guide you through the basics of US stocks, making it easier for you to make informed investment decisions.

What Are US Stocks?

US stocks represent ownership in a company. When you buy a stock, you become a shareholder, which means you own a portion of that company. This ownership can provide you with potential benefits, such as dividends and capital gains.

How Do US Stocks Work?

Stock Market: The US stock market is a platform where buyers and sellers trade stocks. The two main exchanges are the New York Stock Exchange (NYSE) and the NASDAQ.

Trading Hours: The NYSE operates from 9:30 AM to 4:00 PM Eastern Time, while the NASDAQ operates from 9:30 AM to 12:30 PM and 1:00 PM to 4:00 PM.

Stock Symbols: Each stock has a unique symbol, such as AAPL for Apple Inc. and GOOGL for Alphabet Inc. These symbols help identify the company in the market.

Stock Price: The stock price is determined by supply and demand. If more people want to buy a stock, its price will increase. Conversely, if more people want to sell, the price will decrease.

Dividends: Some companies pay dividends to their shareholders, which are portions of the company's profits distributed to owners. Dividends can be a steady source of income for investors.

Capital Gains: If you sell a stock at a higher price than you bought it for, you'll make a capital gain. This gain is subject to taxes.

Investing in US Stocks as an International Student

Open a Brokerage Account: To buy stocks, you need a brokerage account. Many online brokers offer accounts with low fees and easy-to-use platforms.

Research: Before investing, research the company's financial health, industry trends, and management team. This will help you make informed decisions.

Risk Management: As an international student, you may have limited funds. It's crucial to manage your risk by diversifying your portfolio and not investing more than you can afford to lose.

Stay Informed: Keep up with market news and trends. This will help you make timely decisions and avoid panic selling.

Case Study: Apple Inc.

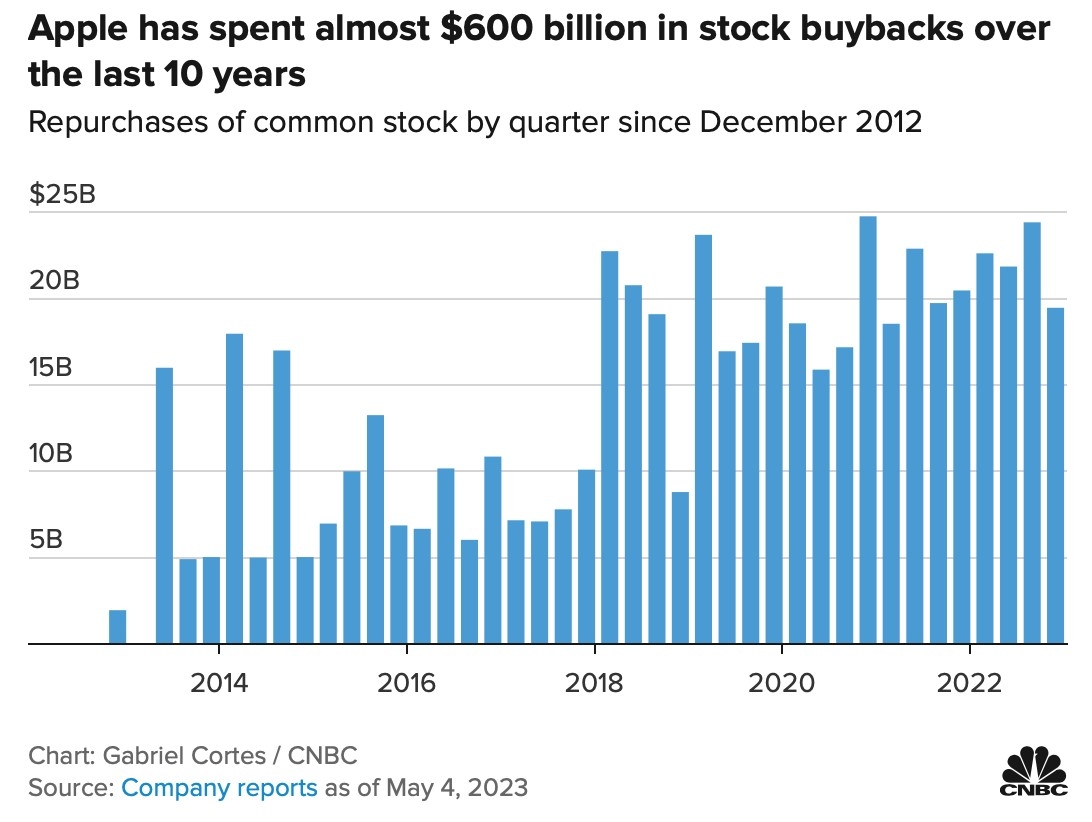

Apple Inc. is a prime example of a successful US stock. Since its IPO in 1980, the company has grown significantly, making it one of the world's most valuable companies. As of 2021, Apple's market capitalization exceeded $2 trillion. This growth has provided substantial returns for investors who bought the stock early.

Conclusion

Investing in US stocks can be a valuable opportunity for international students. By understanding how the market works and managing your risk, you can potentially achieve financial success. Remember to do thorough research and consult with a financial advisor if needed.

new york stock exchange

like

- 2026-01-23Should I Buy US Oil Stocks?

- 2026-01-19Are US Stocks Falling? A Comprehensive Analysis

- 2026-01-19US Penny Stocks News Today: The Latest on Micro-Cap Investments

- 2026-01-23How to Check Toys "R" Us Stock: A Comprehensive Guide

- 2026-01-22JP Morgan US Stock Market Commentary: Key Insights and Analysis

- 2026-01-19Top 10 Huge Loss Stocks in the US Market 2023-2024

- 2026-01-23Stock Market Performance Over the Past 8 Years: A Comprehensive Analysis"

- 2026-01-23New York Stock Exchange List: Your Ultimate Guide to Understanding the Market

- 2026-01-23Turkish Mutual Funds Investing in US Large Growth Stocks: A Lucrative Opportunity

- 2026-01-23S&P 500 by Market Cap: Understanding the Largest Companies in the Index