Market Prediction This Week: Insights and Analysis

In the fast-paced world of finance, staying ahead of market trends is crucial. This week's market prediction brings you insights and analysis that could shape your investment decisions. From stock market movements to economic forecasts, here's what you need to know.

Stock Market Trends

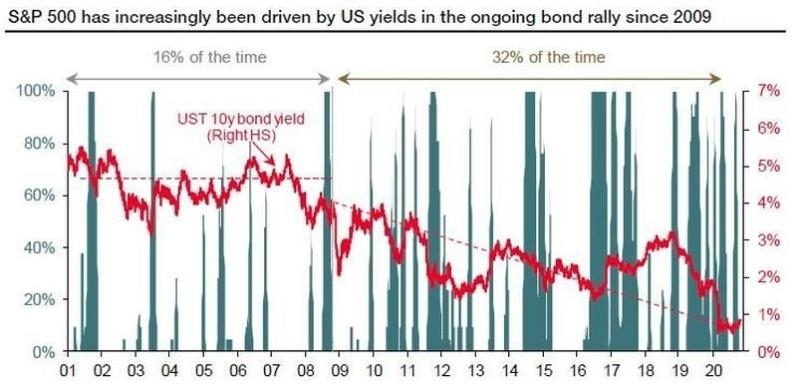

The stock market has been volatile this week, with investors closely watching the Federal Reserve's decisions. The S&P 500 has seen significant fluctuations, and many are wondering if this is a sign of a larger market correction.

One key factor influencing the stock market is the inflation rate, which has been a major concern for investors. The latest report shows that inflation is still above the Federal Reserve's target, leading many to believe that interest rates will continue to rise.

Emerging Market Opportunities

Emerging markets have been a hot topic this week, with many investors looking for opportunities in these areas. Countries like China and India are experiencing strong economic growth, which could translate into significant investment opportunities.

In China, the government's focus on technology and innovation has led to a surge in tech stocks. Meanwhile, in India, the services sector is driving economic growth, making it an attractive destination for investors.

Crypto Market Update

The crypto market has also been a topic of discussion this week, with Bitcoin and other cryptocurrencies experiencing significant volatility. While some are predicting a potential bear market, others believe that the long-term outlook remains positive.

One factor contributing to the volatility is regulatory news, with several countries announcing new regulations aimed at curbing cryptocurrency trading. This has led to uncertainty in the market, but many still see the potential for growth in the long run.

Economic Forecast

Economic forecasts for the coming weeks are cautiously optimistic. The World Bank has predicted moderate global economic growth, with some regions expected to see stronger growth than others.

In the United States, the Federal Reserve's decision on interest rates will be a key factor in the economic forecast. Many believe that a rate hike is imminent, which could have implications for various sectors of the economy.

Case Study: Tesla's Stock Surge

One interesting case study this week is the surge in Tesla's stock. The electric vehicle manufacturer has seen significant growth, thanks to strong sales and innovative technology. This has led many investors to question if Tesla is a good investment.

While Tesla's stock has been on the rise, some analysts warn that it is overvalued. However, others believe that the company's long-term prospects are strong, and that its growth potential makes it a valuable investment.

Conclusion

This week's market prediction brings a mix of optimism and caution. While there are opportunities in various markets, investors should be mindful of the risks involved. By staying informed and making informed decisions, investors can navigate the complexities of the market and potentially benefit from the opportunities that arise.

Remember, the markets are always changing, and staying up-to-date with the latest trends and forecasts is crucial for making informed investment decisions.

stock market hat

like

- 2026-01-23Open Stock Today: Unveiling the World of Trading and Investment Opportunities

- 2026-01-19Best US Stock to Buy Now for Long-Term Investment: A Comprehensive Guide

- 2026-01-23Stock Market Screen: Unveiling the Ultimate Investment Tool"

- 2026-01-23MzrketWatch: Mastering the Art of Market Analysis

- 2026-01-23How Are US Stock Markets Performing in 2023?

- 2026-01-23Unlocking the Power of the S&P 500 Index Fund: A Comprehensive Guide

- 2026-01-23Is Panera a US-Based Stock? Understanding the Investment Opportunity

- 2026-01-19The Biggest Stock Markets in the US: A Comprehensive Guide

- 2026-01-23US Bank Stocks Performance in May 2025: A Comprehensive Analysis

- 2026-01-23Stock Yield Symbol for US Treasury Yields: A Comprehensive Guide