How Are US Stock Markets Performing in 2023?

The US stock market has been a significant indicator of the country's economic health and investor confidence. In 2023, the market has seen its ups and downs, reflecting both the global economic landscape and domestic policies. This article delves into the current state of the US stock market, analyzing key trends and factors that have influenced its performance.

Market Overview

The US stock market, as measured by the S&P 500, has experienced a rollercoaster ride in 2023. The index has seen significant volatility, with both strong gains and sharp declines. As of the latest data, the S&P 500 is up by approximately 10% year-to-date, although it has faced challenges due to various economic factors.

Economic Factors

One of the primary factors influencing the US stock market is the economic landscape. The Federal Reserve's monetary policy, including interest rate decisions, has played a crucial role. The Fed has been raising interest rates to combat inflation, which has affected the stock market's performance. Higher interest rates tend to make borrowing more expensive, which can impact corporate earnings and consumer spending.

Additionally, the global economic environment has had a significant impact on the US stock market. The ongoing trade tensions between the US and China, along with the economic slowdown in Europe, have contributed to market volatility. These factors have led to uncertainty among investors, causing the market to fluctuate.

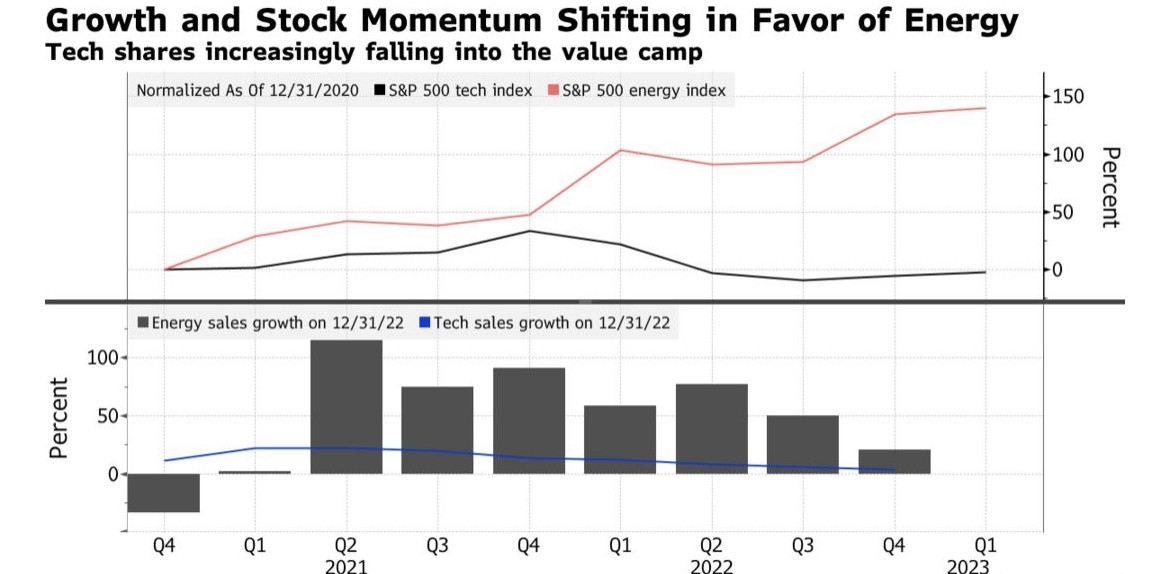

Sector Performance

Different sectors within the US stock market have performed differently in 2023. The technology sector, which includes giants like Apple and Microsoft, has been a major driver of market gains. The sector has seen significant growth, driven by strong earnings reports and innovation in areas like artificial intelligence and cloud computing.

On the other hand, the energy sector has faced challenges due to geopolitical tensions and supply chain disruptions. The war in Ukraine and sanctions against Russia have caused oil prices to soar, impacting energy companies' profitability.

Investor Sentiment

Investor sentiment has also played a crucial role in the US stock market's performance. The current market environment is characterized by a mix of optimism and caution. While investors remain optimistic about the long-term prospects of the US economy, they are also cautious about short-term risks.

The rise of passive investing, particularly through exchange-traded funds (ETFs), has also influenced investor sentiment. Many investors are turning to ETFs for diversification and lower fees, which has affected the performance of individual stocks.

Case Studies

To illustrate the impact of economic factors on the US stock market, let's consider two case studies:

Tesla Inc.: Tesla, the electric vehicle manufacturer, has seen significant volatility in its stock price in 2023. While the company has reported strong sales and earnings, concerns about supply chain disruptions and competition have caused the stock to fluctuate.

NVIDIA Corporation: NVIDIA, a leading graphics processing unit (GPU) manufacturer, has seen strong growth in 2023. The company's success in the gaming and data center markets has contributed to its stock price increase, despite broader market volatility.

Conclusion

The US stock market has been a complex mix of economic factors, sector performance, and investor sentiment in 2023. While the market has seen gains, it has also faced challenges. As investors continue to navigate the current economic landscape, it is crucial to stay informed and adapt to changing market conditions.

stock market hat

like

- 2026-01-19Best US Stock to Buy Now for Long-Term Investment: A Comprehensive Guide

- 2026-01-23Market Closed at What Today: Your Ultimate Guide to Understanding Today's Stock Market Close

- 2026-01-23Child's Farm Baby Moisturizer Stock in the US: Your Ultimate Guide

- 2026-01-19Chart of the Total US Stock Market: A Comprehensive Overview

- 2026-01-23Maximizing Financial Insights with Facebook and Yahoo Finance

- 2026-01-19In-Depth Analysis of MARA.O: Exploring the Future of Reuters' Stock Information"

- 2026-01-23Trade 500: How to Maximize Your Trading Success"

- 2026-01-23Omicron Variant Impact on US Stock Market: What Investors Need to Know

- 2026-01-23S&P USA: Unveiling the Financial Giant's Impact on the Market"

- 2026-01-23Stock Market Gains YTD: A Comprehensive Analysis