Markets Down Again: Understanding the Latest Stock Market Decline

The stock market has been a rollercoaster ride for investors in recent months, and the latest downturn has left many questioning what's next. In this article, we delve into the reasons behind the latest market decline and what it means for investors.

Economic Factors Driving the Decline

Several economic factors have contributed to the recent market downturn. One of the primary reasons is the rising interest rates. The Federal Reserve has been increasing rates to combat inflation, but this has also made borrowing more expensive for businesses and consumers, which can lead to a slowdown in economic growth.

Inflation Concerns

Inflation has been a persistent issue in recent months, and it has been a major concern for investors. The Consumer Price Index (CPI) has been above the Federal Reserve's target of 2% for several months, and this has led to concerns that the central bank may need to raise rates even further to control inflation.

Geopolitical Tensions

Geopolitical tensions have also played a role in the latest market decline. The conflict in Eastern Europe and the ongoing trade disputes between the United States and China have created uncertainty in the global markets, leading to a sell-off in stocks.

Impact on Investors

The latest market downturn has had a significant impact on investors. Many have seen their portfolios decline in value, and this has led to increased volatility in the markets. However, it's important to remember that market downturns are a normal part of investing, and it's crucial to stay focused on long-term goals.

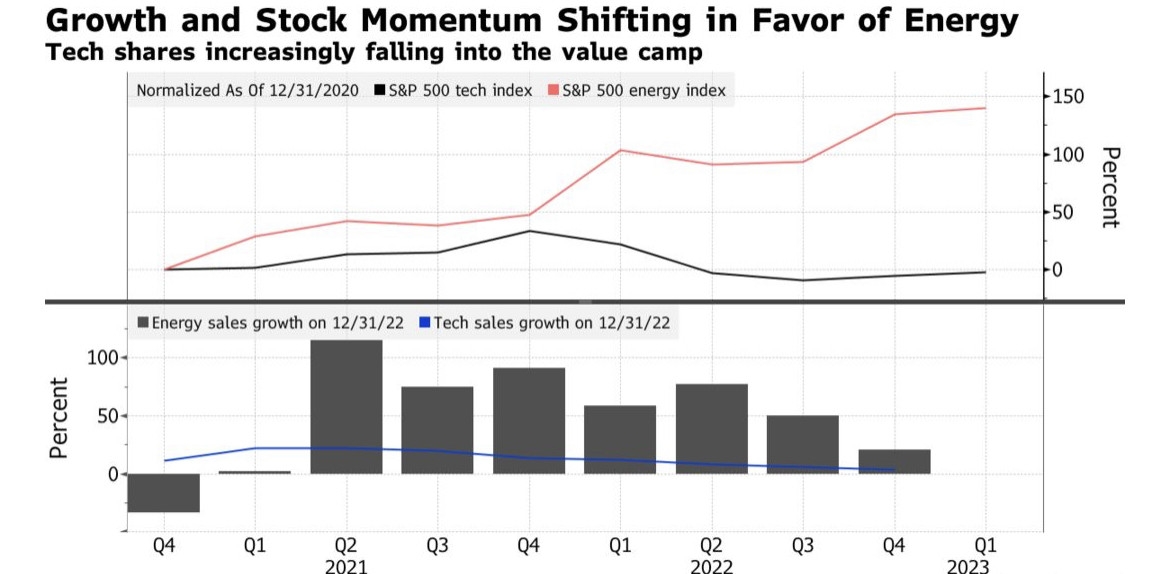

Case Study: Tech Stocks

One of the hardest-hit sectors in the latest market downturn has been technology stocks. Companies like Apple, Microsoft, and Amazon have seen their share prices decline significantly. This decline can be attributed to a variety of factors, including concerns about slowing growth and increased competition.

What Investors Should Do

So, what should investors do in the face of the latest market downturn? Here are a few tips:

- Stay Calm: It's important to stay calm and not react impulsively to market volatility.

- Review Your Portfolio: Take the time to review your portfolio and ensure that it aligns with your long-term investment goals.

- Diversify: Diversification can help reduce risk in your portfolio.

- Consider Adding to Positions: If you have a long-term investment horizon, consider adding to positions in companies you believe in.

Conclusion

The latest market downturn has been a challenging time for investors, but it's important to stay focused on long-term goals. By understanding the reasons behind the downturn and taking appropriate steps, investors can navigate these turbulent times and come out stronger on the other side.

new york stock exchange

like

- 2026-01-23October 5, 2025: A Glimpse into the US Stock Market News

- 2026-01-23Did Stock Market Go Up? A Comprehensive Analysis

- 2026-01-22Maximizing Returns: The Ultimate Guide to US Stock Asset Allocation

- 2026-01-23Amazon Stock: A Deep Dive into US News Insights

- 2026-01-23Stock Market News US Today: Top Stories and Analysis

- 2026-01-23TFSA US Stocks Tax: Everything You Need to Know"

- 2026-01-23Historical NASDAQ Chart: Unveiling Decades of Market Dynamics

- 2026-01-23Maximizing US Stock Capital Gains: Strategies for Tax-Efficient Returns"

- 2026-01-19American States Water: Drip Stocks That Drench Investors

- 2026-01-22Understanding the Importance of an US Stock Certificate