Unlocking the Potential of Trading in the US: A Comprehensive Guide

In today's globalized economy, trading in the US has become a significant opportunity for investors worldwide. Whether you are a seasoned trader or just starting out, understanding the intricacies of the US market is crucial. This article delves into the essentials of trading in the US, providing you with valuable insights and strategies to maximize your potential.

Understanding the US Market

The US stock market is one of the largest and most influential in the world. It encompasses a wide range of companies across various industries, offering investors diverse investment opportunities. The most prominent exchanges in the US include the New York Stock Exchange (NYSE) and the NASDAQ.

Key Considerations for Trading in the US

Regulatory Framework: The US has strict regulatory frameworks, primarily governed by the Securities and Exchange Commission (SEC). Familiarize yourself with the rules and regulations to ensure compliance.

Account Setup: To trade in the US, you need to open a brokerage account with a registered broker-dealer. Compare different brokers based on fees, platform features, and customer service.

Tax Implications: Understand the tax implications of trading in the US. This includes capital gains tax, dividend tax, and foreign tax considerations for international investors.

Market Hours: The US stock market operates from 9:30 AM to 4:00 PM Eastern Time (ET). It is essential to be aware of these hours when planning your trading activities.

Research and Analysis: Conduct thorough research and analysis before making investment decisions. Utilize various tools and resources available to you, including financial news, stock charts, and technical indicators.

Strategies for Successful Trading

Risk Management: Implement a solid risk management strategy to protect your investments. This includes diversifying your portfolio, setting stop-loss orders, and avoiding overleveraging.

Technical Analysis: Technical analysis involves studying past market data to predict future price movements. Utilize various technical indicators and chart patterns to inform your trading decisions.

Fundamental Analysis: Fundamental analysis involves evaluating a company's financial health, industry trends, and economic indicators. This approach helps identify undervalued or overvalued stocks.

Market Sentiment: Stay updated with market sentiment and news that can impact stock prices. This includes economic reports, political events, and corporate earnings announcements.

Continuous Learning: The stock market is dynamic, and continuous learning is crucial for success. Stay informed about market trends, new trading strategies, and regulatory changes.

Case Studies

To illustrate the potential of trading in the US, let's consider a few case studies:

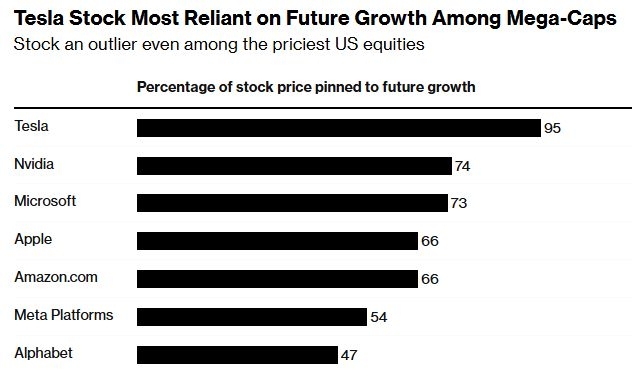

Tesla (TSLA): Tesla has been a significant growth stock in recent years. Investors who identified the company's potential early on have seen substantial returns.

Amazon (AMZN): Amazon has been a dominant player in the e-commerce industry, consistently delivering impressive financial results. Investors who invested in Amazon during its early days have reaped significant profits.

Apple (AAPL): Apple remains one of the most valuable companies in the world. Investors who have remained invested in Apple over the years have experienced substantial growth in their investments.

Conclusion

Trading in the US offers immense potential for investors. By understanding the market, implementing effective strategies, and staying informed, you can maximize your chances of success. Remember to conduct thorough research, manage risks, and continuously learn to stay ahead in the dynamic world of trading.

new york stock exchange

like

- 2026-01-23Understanding Long-Term Capital Gains Tax on US Stocks"

- 2026-01-23Canada Yahoo Finance: Unveiling the Best Financial Resources

- 2026-01-23Avg US Stock Market Growth Rate: A Comprehensive Analysis

- 2026-01-22US Pacific Marine Mammal Stock Assessments 2013: A Comprehensive Review

- 2026-01-23Unlocking the Potential of GTII Stock: A Comprehensive Analysis for US Investors

- 2026-01-23Markets Lower: Understanding the Current Economic Climate

- 2026-01-22The Ultimate Guide to the Best Trading Platform for US Stocks

- 2026-01-23SPF 500 Stocks: The Ultimate Guide to Understanding and Investing in the S&P 500

- 2026-01-23Meta StockInvest: Revolutionizing the Way You Invest

- 2026-01-22Unlocking the Potential of U.S. Ecol Stock: A Comprehensive Guide