Has the US Stock Market Bottomed Out? A Comprehensive Analysis

The stock market has always been a rollercoaster ride, and the recent volatility has left many investors questioning whether the market has finally bottomed out. With the ongoing economic uncertainty, this question is more pressing than ever. In this article, we will delve into the current state of the US stock market, analyze key indicators, and provide insights into whether we have reached the bottom or if there's still more to come.

Market Performance in 2023

In 2023, the US stock market has experienced a turbulent year. The market opened the year with a strong rally, driven by hopes of economic recovery and low-interest rates. However, the rally was short-lived, as the market faced a series of challenges, including rising inflation, supply chain disruptions, and geopolitical tensions.

Key Indicators

To determine whether the market has bottomed out, we need to analyze key indicators. Here are some of the most important ones:

Economic Data: Economic indicators such as GDP growth, unemployment rate, and inflation play a crucial role in determining market trends. In recent months, the US economy has shown signs of slowing down, which could be a positive sign for the stock market.

Valuations: Valuations are a critical factor in determining the market's health. Currently, the stock market is trading at a discount to its historical averages, which suggests that the market might have reached a bottom.

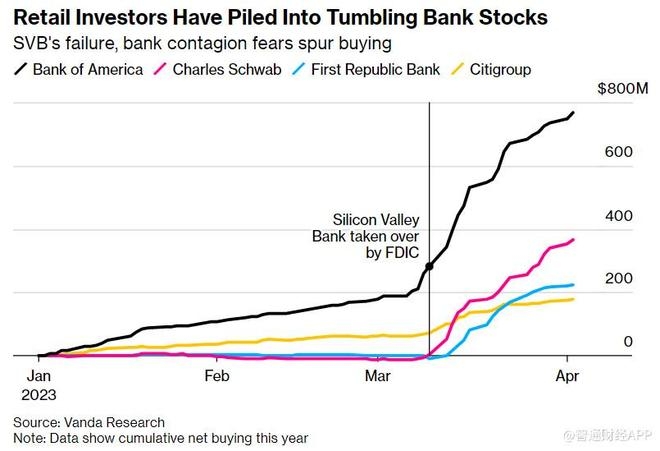

Sentiment: Investor sentiment can significantly impact market movements. While sentiment has been negative in recent months, it's essential to consider that panic selling often precedes a market bottom.

Earnings Reports: Company earnings reports provide valuable insights into the health of the stock market. If companies are reporting strong earnings despite the challenging economic environment, it could indicate that the market has bottomed out.

Case Studies

To further understand the current market situation, let's look at a couple of case studies:

Technology Sector: The technology sector has been a significant driver of the US stock market's growth. In recent months, major tech companies like Apple, Microsoft, and Google have reported strong earnings, which suggests that the sector is likely to remain robust despite the market's volatility.

Energy Sector: The energy sector has been another bright spot in the stock market. With the ongoing global energy crisis, companies like ExxonMobil and Chevron have seen their stock prices soar, indicating that the sector might have bottomed out.

Conclusion

While it's challenging to predict the exact bottom of the stock market, the current indicators and case studies suggest that the market might have reached a bottom. However, it's crucial to remain cautious and monitor key indicators closely to make informed investment decisions. As always, consult with a financial advisor before making any investment decisions.

us stock market today live cha

like

- 2026-01-23Has the US Stock Market Bottomed Out? A Comprehensive Analysis

- 2026-01-22Soybean Market: US Stock Insights and Analysis"

- 2026-01-22Bloomberg US Stock Quotes: Your Ultimate Guide to Real-Time Market Information

- 2026-01-19"The Child in US: A Captivating Stock Photo That Tells a Story"

- 2026-01-23Nasdaq Company Search: Unveiling the Power of the Stock Market's Premier Hub

- 2026-01-22South Korean Stocks: A Rising Star in the US Market"

- 2026-01-22Unlocking Investment Opportunities: Understanding U.S. Stock Broker Accounts for Non-Residents

- 2026-01-22Title: Best Site for US Stock Analysis: Unveiling the Ultimate Resource

- 2026-01-22Unlocking the Potential of Tanzanite: A Comprehensive Guide to US Stock Investments

- 2026-01-19Total US Stock Market Capitalization in April 2025: A Comprehensive Analysis