Stock in Top US Companies: A Smart Investment Strategy

Investing in the stock market can be a daunting task, especially for beginners. However, investing in top US companies can be a smart strategy to grow your wealth over time. In this article, we will explore the benefits of investing in the top US companies and provide some insights on how to identify these companies.

Understanding Top US Companies

Top US companies are those that have a strong market presence, significant revenue, and a solid financial foundation. These companies often dominate their respective industries and have a proven track record of success. Some of the most well-known top US companies include Apple, Microsoft, Amazon, Google (Alphabet), and Facebook (Meta).

Benefits of Investing in Top US Companies

Stability and Growth: Top US companies are known for their stability and consistent growth. These companies have a strong financial foundation and a proven track record of success, making them less likely to face financial difficulties.

Dividends: Many top US companies offer dividends to their shareholders. Dividends are a portion of the company's profits that are distributed to shareholders, providing an additional source of income.

Market Dominance: Top US companies often have a significant market share in their respective industries. This market dominance allows them to generate substantial revenue and profits.

Innovation: Many top US companies are known for their innovation and ability to adapt to changing market conditions. This innovation can lead to new products, services, and growth opportunities.

How to Identify Top US Companies

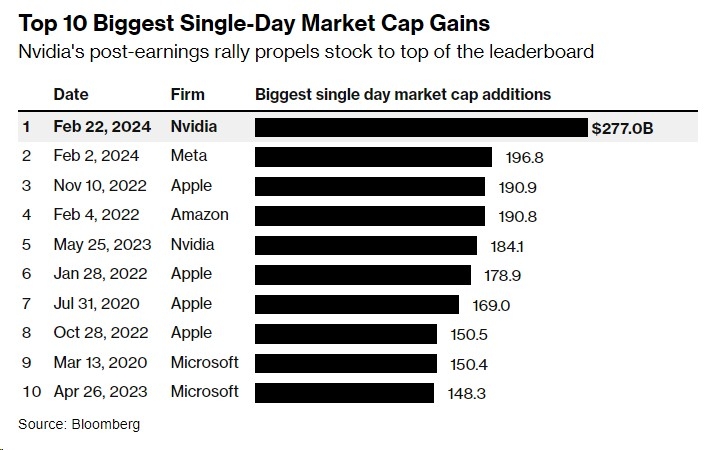

Market Capitalization: Market capitalization is a measure of a company's size and value. Companies with a high market capitalization are often considered to be top companies. You can find the market capitalization of a company by looking at its stock price and the number of outstanding shares.

Financial Health: Look for companies with strong financial health, including a high return on equity (ROE), low debt-to-equity ratio, and consistent revenue growth.

Industry Position: Consider companies that are market leaders in their respective industries. These companies often have a competitive advantage and are more likely to succeed in the long term.

Management Team: Look for companies with a strong and experienced management team. A capable management team can make a significant difference in a company's success.

Case Studies

Apple: Apple is a prime example of a top US company. The company has a strong market presence, significant revenue, and a solid financial foundation. Apple has also been known for its innovation, launching products like the iPhone, iPad, and Apple Watch.

Microsoft: Microsoft is another top US company with a strong market presence and consistent revenue growth. The company has diversified its business, including software, cloud computing, and hardware.

Amazon: Amazon is a leader in the e-commerce industry, with a significant market share and a strong financial foundation. The company has also expanded into other areas, such as cloud computing and streaming services.

Investing in top US companies can be a smart strategy for growing your wealth over time. By understanding the benefits of investing in these companies and how to identify them, you can make informed investment decisions. Remember to do thorough research and consult with a financial advisor before making any investment decisions.

us stock market today

like

- 2026-01-19Can You Get Nintendo Stock US? A Comprehensive Guide

- 2026-01-22Top Momentum Stocks: US Large Cap Past Week – September 2025

- 2026-01-19Top US Energy Stocks: A Comprehensive Guide to Investment Opportunities

- 2026-01-19Aphria Inc US Stock Symbol: A Comprehensive Guide to Investing in Aphria

- 2026-01-22Buying US Stocks in Canada: A Comprehensive Guide

- 2026-01-19How Malaysians Invest in U.S. Stocks: A Comprehensive Guide"

- 2026-01-22Trade Canadian Stocks in the US: Your Ultimate Guide

- 2026-01-22US Shariah Compliant Stocks List: A Comprehensive Guide

- 2026-01-19United Utilities Group Stock: A Comprehensive Analysis

- 2026-01-22Top US Pharma Stocks to Watch in 2023: A Comprehensive Guide"