Cycles of Us vs. International Stocks: Navigating the Global Market

In the ever-evolving world of finance, investors are constantly seeking opportunities to maximize their returns. One of the most debated topics among investors is whether to invest in U.S. stocks or international stocks. This article delves into the cycles of U.S. vs. international stocks, highlighting the key factors that influence these markets and providing insights for investors looking to navigate the global landscape.

Understanding the Cycles

The stock market is cyclical, and both U.S. and international stocks experience fluctuations over time. Understanding these cycles is crucial for investors looking to make informed decisions.

U.S. Stock Market Cycles

The U.S. stock market has been a cornerstone of global investment for decades. It is characterized by several key cycles:

- Economic Cycles: The U.S. economy goes through periods of expansion and contraction, which can significantly impact the stock market. During economic expansions, companies tend to perform well, leading to higher stock prices. Conversely, during economic downturns, companies may struggle, resulting in lower stock prices.

- Market Cycles: The stock market itself goes through bull and bear markets. Bull markets are characterized by rising stock prices, while bear markets are marked by falling stock prices. These cycles can last for years and are influenced by a variety of factors, including economic conditions, investor sentiment, and geopolitical events.

International Stock Market Cycles

International stock markets also experience similar cycles, but they can be influenced by additional factors such as currency fluctuations, political instability, and economic differences between countries.

- Currency Fluctuations: The value of the U.S. dollar can significantly impact international stocks. When the dollar strengthens, international stocks may become less attractive to U.S. investors, as they will receive fewer U.S. dollars for their investments. Conversely, when the dollar weakens, international stocks may become more attractive.

- Political and Economic Instability: Countries with political and economic instability may experience volatility in their stock markets. This can make investing in these markets riskier and less predictable.

Navigating the Cycles

Investors must carefully consider the cycles of U.S. vs. international stocks when making investment decisions. Here are some key considerations:

- Diversification: Diversifying your portfolio across U.S. and international stocks can help mitigate risk and potentially enhance returns. By investing in both markets, you can benefit from the strengths and weaknesses of each.

- Risk Tolerance: Your risk tolerance will play a significant role in your investment decisions. International stocks may offer higher potential returns, but they also come with higher risk. It's important to choose investments that align with your risk tolerance.

- Research and Analysis: Conduct thorough research and analysis before investing in either U.S. or international stocks. This includes understanding the economic, political, and market conditions of the countries in which you are investing.

Case Studies

To illustrate the cycles of U.S. vs. international stocks, let's consider two case studies:

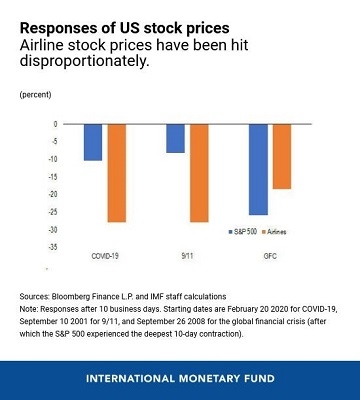

- 2008 Financial Crisis: During the 2008 financial crisis, the U.S. stock market experienced significant volatility and a bear market. In contrast, some international markets, such as those in Asia, performed relatively well. This highlights the importance of diversification and understanding the cycles of different markets.

- 2020 COVID-19 Pandemic: The COVID-19 pandemic caused a global economic downturn, impacting both U.S. and international stocks. However, some international markets, such as those in China and India, experienced a faster recovery than the U.S. market. This demonstrates the potential for different markets to perform differently during economic downturns.

In conclusion, the cycles of U.S. vs. international stocks are complex and influenced by a variety of factors. By understanding these cycles and carefully considering your investment strategy, you can navigate the global market and potentially achieve your investment goals.

us flag stock

like

- 2026-01-22How to Trade in the US Stock Market from the Philippines: A Comprehensive Guide

- 2026-01-23Unlocking the Power of the S&P 500: A Comprehensive Guide

- 2026-01-23Understanding NYSE Stock Codes: The Key to Investment Success

- 2026-01-23Fox News No Stock Ticker: What It Means and Why It Matters

- 2026-01-23Stock Markets Right Now: A Comprehensive Insight"

- 2026-01-19STCG on US Stocks: Maximizing Capital Gains Tax Efficiency

- 2026-01-19RBC US Top Stock Picks: Unveiling the Best Investments for 2023

- 2026-01-23Marketplace Today: The Dynamic Ecosystem of Online Retail"

- 2026-01-23Can Stadler Rail Be Bought on the US Stock Market?

- 2026-01-19Dow Jones US Broad Stock Market: A Comprehensive Overview"