Understanding Stock Indexes Year to Date: A Comprehensive Guide

In the ever-changing world of finance, staying informed about stock indexes is crucial for investors and traders alike. "Stock indexes year to date" refers to the performance of a stock index from the beginning of the current calendar year up until the present date. This metric is a valuable tool for assessing market trends and making investment decisions. In this article, we will delve into what stock indexes year to date are, how they are calculated, and their significance in the investment landscape.

What are Stock Indexes Year to Date?

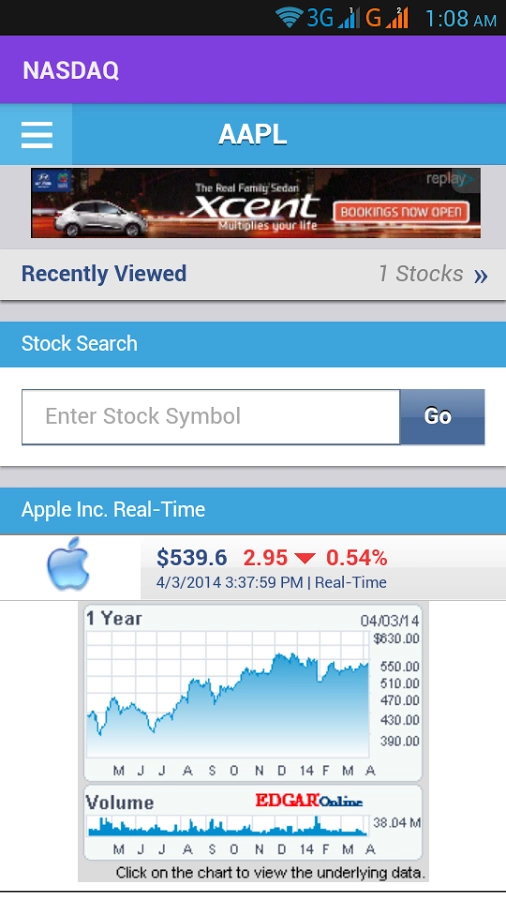

Stock indexes, such as the S&P 500, the Dow Jones Industrial Average, and the NASDAQ Composite, are composite measures of the performance of a group of stocks. They provide a snapshot of market trends and can be used as a benchmark to compare the performance of a particular portfolio or sector against the broader market.

Year to Date Performance

"Year to date" refers to the time period from the start of the calendar year to the current date. For instance, if we are in June, the year to date would be from January 1st to June 30th. Tracking stock indexes year to date allows investors to see how the market has performed over a specific time frame, which can be useful for making informed decisions.

How are Stock Indexes Calculated?

Stock indexes are calculated using various methodologies, but the most common is the price-weighted index. This method assigns a weight to each stock in the index based on its price. For example, if a stock with a price of

Another common method is the market capitalization-weighted index, which assigns a weight to each stock based on its market value. This method gives more influence to larger companies with higher market capitalizations.

Significance of Stock Indexes Year to Date

Understanding stock indexes year to date is crucial for several reasons:

- Market Trends: By analyzing year-to-date performance, investors can identify trends and patterns in the market that may influence their investment strategies.

- Portfolio Performance: Comparing the performance of a portfolio against major stock indexes can help investors assess whether their investments are performing as expected.

- Risk Management: Investors can use year-to-date data to evaluate the risk associated with different sectors or individual stocks.

- Economic Indicators: Stock indexes often serve as economic indicators, reflecting the overall health of the market and the economy.

Case Study: The S&P 500 Year to Date

One of the most widely followed stock indexes is the S&P 500, which tracks the performance of 500 large companies listed on the stock exchanges in the United States. As of June 2023, the S&P 500 had experienced a significant rise year to date, reflecting a strong market performance.

This rise can be attributed to several factors, including strong earnings reports from major companies, a recovering economy, and favorable interest rate policies. However, it's important to note that market conditions can change rapidly, and investors should stay informed about the latest trends and news.

Conclusion

Stock indexes year to date are a vital tool for investors and traders looking to understand market trends and make informed decisions. By analyzing the performance of major stock indexes, investors can gain valuable insights into the market and their own portfolios. Whether you're a seasoned investor or just starting out, understanding stock indexes year to date is a fundamental skill for navigating the dynamic world of finance.

stock market hat

like

- 2026-01-23Unlocking Success: The Power of CNN Pre-Trading in the Financial Markets

- 2026-01-23The Evolution of the Stock Market: A Visual Journey Through History

- 2026-01-23Maximizing Returns: The Power of Market on Close Trading Strategies"

- 2026-01-22Blue Chip US Dividend Stocks: Top Picks for Long-Term Investors"

- 2026-01-23Maximizing Financial Insights with Facebook and Yahoo Finance

- 2026-01-23How Many Points Is the Stock Market Down Today?

- 2026-01-22US Senators Sold Stocks Amid Market Volatility: What It Means for Investors

- 2026-01-19The Biggest Stock Markets in the US: A Comprehensive Guide

- 2026-01-23Unveiling the S&P 500 Earnings: Key Insights and Impact"

- 2026-01-22Baba Us Stock Price: What You Need to Know