Dow Jones Down Today: Why It Matters

The Dow Jones Industrial Average (DJIA) experienced a decline today, sparking questions among investors and financial analysts alike. But why did the Dow Jones down today? In this article, we'll delve into the reasons behind the drop and its implications for the market.

Understanding the DJIA

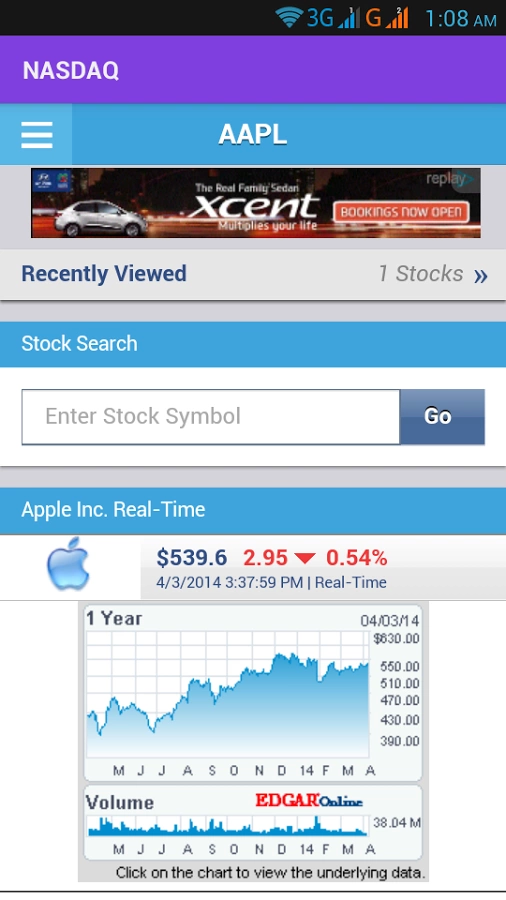

Firstly, it's crucial to understand that the Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange (NYSE) and the NASDAQ. It represents a cross-section of the stock market and is widely regarded as a bellwether for the overall economy.

Reasons for the Decline

Several factors could have contributed to the Dow Jones down today:

Global Economic Concerns: The ongoing trade tensions between the United States and China have raised concerns about global economic growth. As the world's two largest economies, any instability in their relationship can have far-reaching consequences.

Corporate Profits: Companies are facing increased costs due to tariffs and other economic uncertainties, which may lead to a decline in profits. This concern has prompted investors to sell off their stocks, causing the Dow Jones to fall.

Interest Rates: The Federal Reserve's recent decision to raise interest rates has made borrowing more expensive for companies and consumers. This can lead to reduced spending and investment, which in turn can affect corporate earnings and the stock market.

Political Instability: The recent political turmoil in certain countries, such as Hong Kong and Lebanon, has added to the global economic uncertainty. This instability can lead to a sell-off in stocks as investors seek safer investments.

Impact on the Market

The Dow Jones down today has raised concerns about the health of the stock market. However, it's important to remember that market fluctuations are a normal part of the investing process. The key is to maintain a long-term perspective and not react impulsively to short-term volatility.

Case Studies

Let's consider a few case studies to illustrate the impact of economic factors on the Dow Jones:

2008 Financial Crisis: In the lead-up to the financial crisis, the Dow Jones experienced significant volatility. Factors such as the subprime mortgage crisis, credit market turmoil, and global economic downturn contributed to the decline in the DJIA.

2019 Trade War: The trade tensions between the United States and China in 2019 caused the Dow Jones to fluctuate significantly. Investors were concerned about the potential impact of tariffs on corporate earnings and global economic growth.

Conclusion

The Dow Jones down today reflects the broader economic concerns and uncertainty that are currently affecting the market. While it's important to monitor market movements, it's equally crucial to maintain a long-term investment strategy and not panic during periods of volatility.

stock market hat

like

- 2026-01-23IndexNYSEGis XAX: The Ultimate Guide to Understanding Your Electric Utility

- 2026-01-23All Us Coal Stocks: A Comprehensive Analysis

- 2026-01-22Discover the Power of Us Bank Stock Photos

- 2026-01-22US Bioplastic Stocks: A Sustainable Investment Opportunity"

- 2026-01-23FTX US Stocks: The Ultimate Guide to Trading on FTX"

- 2026-01-23Unlocking the Potential of KMPH.O: A Deep Dive into KMPH Group's Stock

- 2026-01-22Us Army Women Vintage Stocking: A Timeless Fashion Statement

- 2026-01-19Universal Health Services (US) Stocks: A Comprehensive Guide

- 2026-01-23Nasdaq Index Daily: A Comprehensive Guide to Today's Market Trends"

- 2026-01-19The Intricate Relationship Between Chinese Stocks' Multiple Listing in the US and China