Are Stock Markets Crashing? Understanding the Current Landscape

In recent weeks, the stock market has been a hot topic of discussion, with many investors and market watchers asking, "Are stock markets crashing?" The volatility in the market has raised concerns and prompted a closer look at the factors contributing to this uncertainty. This article delves into the current state of the stock market, analyzing the causes of the recent downturn and offering insights into what investors should expect moving forward.

What's Causing the Stock Market Volatility?

The primary driver behind the current stock market volatility is the ongoing trade tensions between the United States and China. As both countries impose tariffs on each other's goods, the global economy is facing uncertainty, which has a direct impact on the stock market. Additionally, the Federal Reserve's decision to raise interest rates has also contributed to the market's instability.

Impact on Different Sectors

The impact of the stock market volatility has been felt across various sectors. Technology stocks, which have been a major driver of the market's growth in recent years, have seen significant declines. Energy stocks have also been affected, as the rise in interest rates has made borrowing more expensive for companies in the sector. Meanwhile, consumer discretionary stocks have been hit hard, as consumers cut back on spending in response to rising prices and economic uncertainty.

Case Studies: Tech Giants and Energy Companies

To illustrate the impact of the stock market volatility, let's look at a couple of case studies. Apple Inc., one of the largest technology companies in the world, has seen its stock price decline by nearly 20% in the past few months. Similarly, Exxon Mobil Corporation, the largest publicly traded oil and gas company, has seen its stock price drop by more than 10% over the same period.

What Should Investors Do?

Given the current market conditions, investors should be cautious and consider the following strategies:

- Diversify Your Portfolio: Diversification can help mitigate the risk of a stock market crash. By investing in a variety of asset classes, you can reduce your exposure to any single sector or stock.

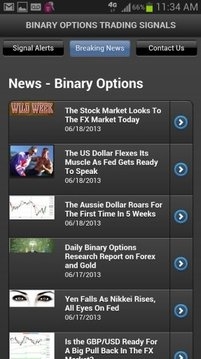

- Stay Informed: Keep up with the latest news and developments in the market. This will help you make informed decisions and stay ahead of potential market trends.

- Review Your Investment Strategy: If you're not comfortable with the current market conditions, it may be time to review your investment strategy. Consider consulting with a financial advisor to help you navigate the market.

Conclusion

While the stock market's recent volatility has raised concerns, it's important to remember that markets have always experienced ups and downs. By staying informed and maintaining a diversified portfolio, investors can navigate these challenging times and position themselves for long-term success.

stock market hat

like

- 2026-01-23How Did the Dow Jones Industrial Do Today?

- 2026-01-22Unlocking the Beauty of US Household Stocks: A Deep Dive into NYSE-ELF's ELF-BEAUTY

- 2026-01-23Most Volatile US Stocks to Watch in August 2025

- 2026-01-22Number of Companies Listed on U.S. Stock Exchanges: A Comprehensive Insight"

- 2026-01-19US Natural Gas Stock Quote: A Comprehensive Guide to Understanding Natural Gas Investments

- 2026-01-23What Are the Dow and S&P 500?

- 2026-01-22Toys "R" Us Stock Over Time: A Comprehensive Analysis

- 2026-01-23iyf TV App: Revolutionizing Streaming Experience

- 2026-01-22About Us Stock Images: Elevate Your Brand's Story

- 2026-01-23Nasdaq Index Daily: A Comprehensive Guide to Today's Market Trends"