US Foods Stock Outlook: What You Need to Know

Introduction

The US food industry is a bustling sector with numerous opportunities for investors. As the world's largest agricultural exporter, the United States has a significant share in the global food market. With this in mind, let's delve into the US foods stock outlook and what it means for investors.

Market Overview

The US food industry is segmented into various segments, including processed foods, fresh produce, and foodservice. Each segment has unique growth drivers and challenges. Understanding these segments is crucial for a comprehensive outlook on the US foods stock market.

Processed Foods

Processed foods, which include items like canned goods, frozen meals, and snack bars, have been a staple in the US food industry for decades. These products are convenient and offer a longer shelf life, making them popular among consumers. Key players in this segment include ConAgra Foods, Campbell Soup Company, and Mondelez International.

Fresh Produce

The fresh produce segment has seen a surge in demand, thanks to health-conscious consumers and the rise of organic products. This segment includes fruits, vegetables, and other perishable goods. Companies like Taylor Farms, Dole Food Company, and Fresh Del Monte Produce have capitalized on this trend.

Foodservice

The foodservice industry encompasses restaurants, cafes, and catering services. This segment has faced challenges due to the pandemic, but it is gradually recovering. Key players in this segment include McDonald's, Starbucks, and Wendy's.

Emerging Trends

Several trends are shaping the US foods stock market, including:

- Health and Wellness: Consumers are increasingly seeking healthier options, leading to a rise in demand for organic, non-GMO, and low-sugar products.

- Sustainability: Companies that prioritize sustainability, such as those using eco-friendly packaging and reducing food waste, are gaining a competitive edge.

- Technology: The integration of technology in the food industry, such as online ordering and delivery services, is changing consumer behavior and creating new opportunities.

Investment Opportunities

Several investment opportunities are available in the US foods stock market, including:

- Dividend Stocks: Companies with a strong financial position and consistent dividend payments can be good long-term investments. Examples include ConAgra Foods and Campbell Soup Company.

- Growth Stocks: Companies with high growth potential, such as those in the fresh produce and foodservice sectors, can offer significant returns. Examples include Taylor Farms and McDonald's.

- Mergers and Acquisitions: The food industry is ripe for consolidation, with numerous opportunities for mergers and acquisitions that can create value for shareholders.

Case Study: Mondelez International

Mondelez International, a leading player in the processed foods segment, has seen a significant increase in its stock price over the past few years. This growth can be attributed to several factors, including a strong focus on health and wellness, innovation, and strategic acquisitions.

Conclusion

The US foods stock outlook is promising, with numerous opportunities for investors. By understanding the market segments, emerging trends, and investment opportunities, investors can make informed decisions and potentially reap significant returns.

new york stock exchange

like

- 2026-01-19Are US Stocks Falling? A Comprehensive Analysis

- 2026-01-22Title: In-Depth Analysis of NTDoy.pk: The Rising Star in http Stocks

- 2026-01-22Top Momentum Stocks in the US This Week: A Deep Dive

- 2026-01-22Understanding the US Stock Fear and Greed Index: A Comprehensive Guide"

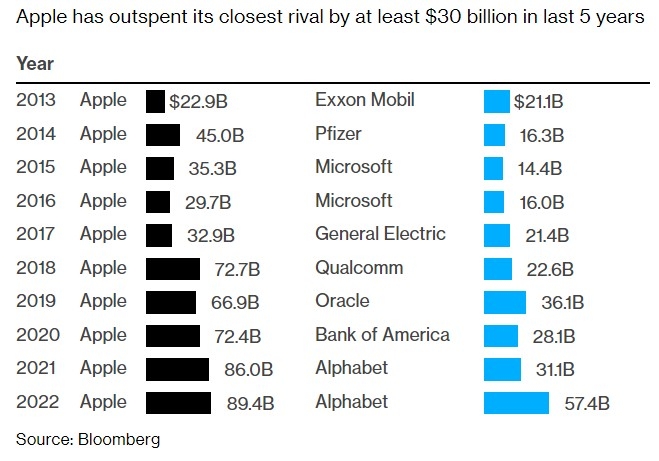

- 2026-01-22US Stock Buybacks by Year: A Decade-by-Decade Analysis

- 2026-01-19Long-Term US Stock Market Returns: A Comprehensive Guide"

- 2026-01-22Unveiling the Latest US Stock Financial Report: A Comprehensive Overview

- 2026-01-19Intel Stock Ownership by U.S. Government Agencies: An Insightful Analysis"

- 2026-01-19American States Water: Drip Stocks That Drench Investors

- 2026-01-22US Cannabis Stocks News: Latest Updates and Investment Insights